Schiphol Airport

CUSTOMS Offices & REFUND Locations.

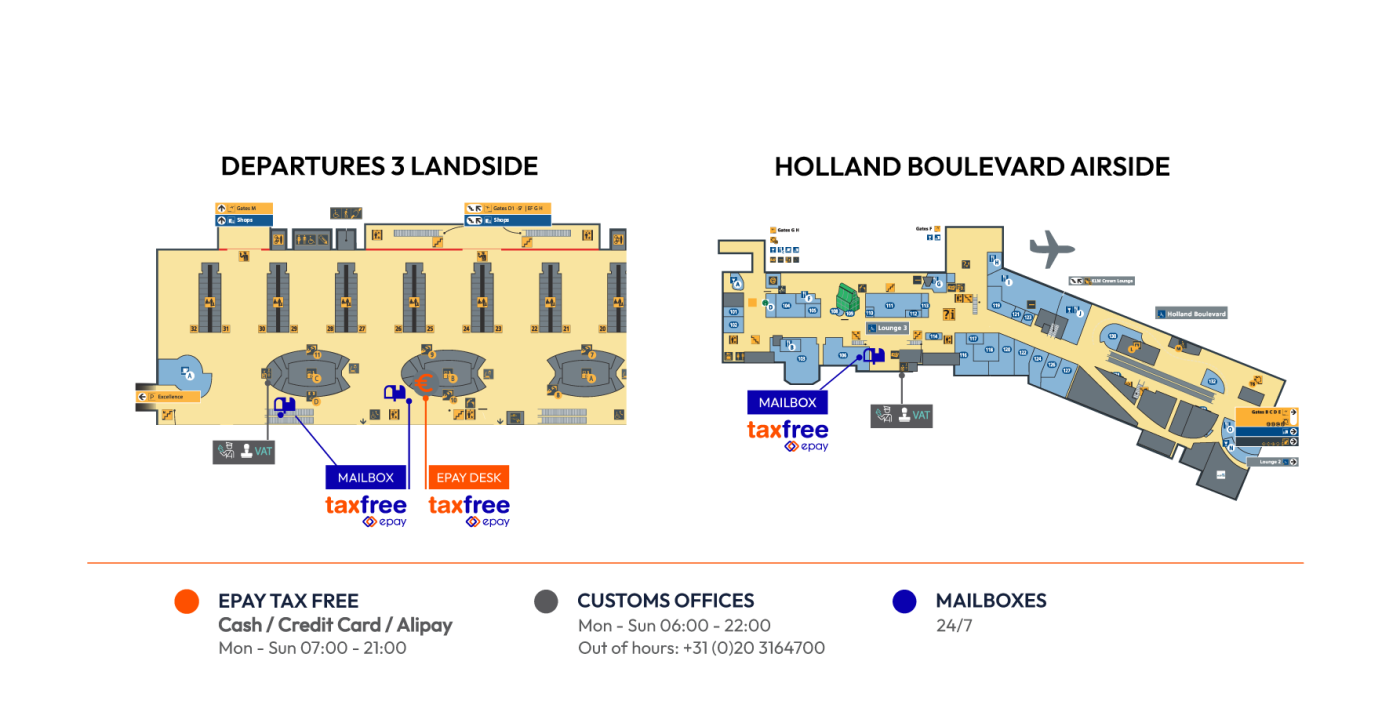

Remember to arrive at the airport early to process your VAT refund and validate your Tax Free form before checking in your luggage. Customs authorities may ask to see your purchase.

What is the NEW

NL Digital System?

Starting January 1st, 2026, The Netherlands has launched the digital process for validating Tax Free forms issued within its territory.

Tax Free validation is now also performed digitally by Dutch Customs.

Travelers can choose between:

• Validation at the Dutch Customs desk at the airport

• Using the official Dutch Customs app

NL Customs VAT App.The official application of the Dutch government

The Netherlands

VAT Refund

Request your Tax Free form

Normal rate: 21%

Reduced rate: 9%

Minimum purchase amount: 50€

Stamp

You have a period of 3 months from the purchase date to get the Tax Free forms validated by Customs before leaving the European Union. Please, get your form stamped before doing the check-in of your luggage.

Get your Refund

Get your refund in cash at our refund points or by credit card. You have 4 years from the date of purchase to get your refund.

Conditions of each country to get the refund of my Tax Free

The countries of the European Union are: Austria, Belgium, Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Poland, Portugal, Romania, Slovak Republic, Slovenia, Spain, Sweden and the Netherlands.

Exception: Residents of Andorra, Busingen, Campione d’Italia, Ceuta, Gibraltar, Guadeloupe, French Guiana, Helgoland, Aland Islands, Canary Islands, Channel Islands, Lake Lugano, Livigno, Martinique, Melilla, Mount Athos, Reunion, Saint-Martin (French Part) are entitled to Tax Free service.

Empower your Tax Free Experience

#epayTaxFree

#epayTaxFree