What is Tax Free Shopping?

Tax Free shopping means «VAT Refund». In other words, shopping Tax Free means saving on the purchases you make when travelling to certain countries abroad, as the taxes or duties levied on certain products will be discounted and returned to you.

Keep in mind that different regulations apply to most Tax Free countries, thus to apply the discount, they may require you to meet a minimum spending in the local currency, either on each product or shop, or on the total of your purchases.

epay Tax Free is here to guide you through – visit the link below to find out what is applicable to your destination country!

How to shop Tax Free?

SHOP

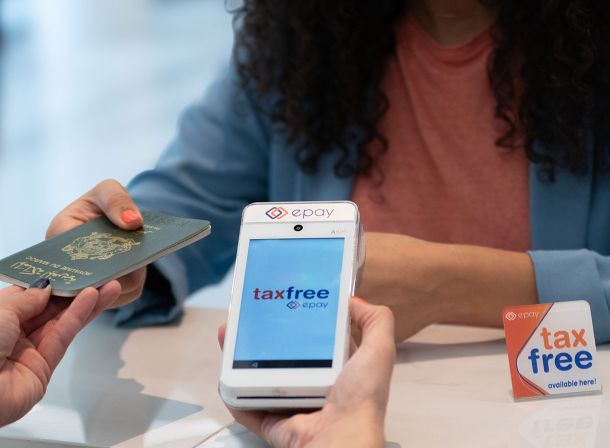

Before paying for your purchase, ask store staff for an epay Tax Free Form. Fill out the form and verify that all your data are correct.

We recommend scanning the QR code on each Tax Free form to manage your refunds digitally from your mobile.

VALIDATE

Go to the Customs approval point before your flight home. Present your Tax Free forms, your travel documents and purchased goods to obtain approval.

Validation will either be a stamp or electronic approval from a kiosk, depending on the departure point.

REFUND

If you get your refund in-store or at a city center point, to avoid charges and a penalty, you must return the export-validated form to us within a specified time period. This step does not apply to airport refunds.

Please check the local rules that apply to your destination.

When can I get my VAT refund?

We provide a range of options to obtain your refund at any time before or after stamping your Tax Form.

We provide a range of options to obtain your refund at any time before or after stamping your Tax Form.

IN-STORE

Immediate in-store discount or credit card refund within 48 hours, managed by the merchant, at the time of issuing the Tax Free form.

IN TOWN: «CITY CASH»

Cash refunds at more than 60 city locations prior to Customs stamping

AIRPORT CASH

Cash refund network at major departure points, such as Ports and Airports.

QR CODE

One-step self-management of the refund on credit card or Alipay account by scanning a QR code generated on the Tax Free form.

Who is entitled to Tax Free?

You are entitled to a VAT refund if you reside outside the European Union and visiting one or more EU countries. To find answers to the questions you may have about epay Tax Free service check out our FAQ for shoppers.

Where to Scan your Tax Free form QR code?

Did you know that you can control your VAT refund on your smart phone? epay Tax Free developed a Smart Solution to make your life easier!

The first step is towards your refund is to simply scan the QR code on your Tax Free form.

Now you can manage all your VAT refunds onto your CARD/ALIPAY, by simply scanning the QR Code on the Tax Free form or enter your Tax Free form number.

Are there any VAT Refund Tips?

Yes! First and foremost, don’t forget to stamp your Tax Free form.

Remember that the conditions change depending on the Country for which you leave the European Union.

At the airport or port, go to the Customs and present your completed Tax Free Form, passport, receipts and purchases to get your customs approval.

Empower your Tax Free Experience

#epayTaxFree

#epayTaxFree